LTC Price Prediction: Bullish Momentum Builds Toward Key Resistance

#LTC

- LTC trades above key moving average with positive MACD crossover

- PayPal integration and ETF anticipation provide fundamental support

- Upper Bollinger Band at $123.83 represents near-term target

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge

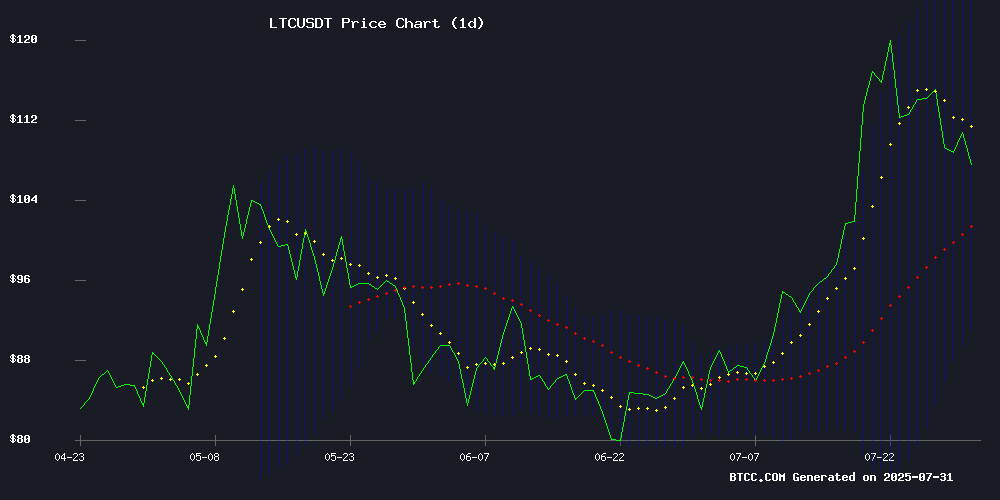

According to BTCC financial analyst Michael, Litecoin (LTC) is showing bullish technical signals as it trades above its 20-day moving average (107.4870 USDT). The MACD histogram has turned positive (0.5585), suggesting growing momentum. With the price (109.91 USDT) hovering near the upper Bollinger Band (123.8379), LTC may test resistance levels if buying pressure continues.

Market Sentiment Turns Positive for Litecoin

BTCC's Michael notes bullish catalysts for LTC including PayPal's new crypto payment feature and Litecoin approaching key resistance levels. While the SEC delayed Grayscale's LTC ETF decision, the price held steady at $109 - a sign of strength amid regulatory uncertainty. The PELOSI Act's progress bears monitoring, but current news flow appears supportive for LTC.

Factors Influencing LTC's Price

DNSBTC Emerges as Leading Cloud Mining Platform Amid Bitcoin Rally

Bitcoin's rebound above $118,000 has reignited market enthusiasm, with cloud mining platform DNSBTC capitalizing on the momentum. The U.S.-based provider, founded in 2020 and now ranked as the top service in 2025, offers automated mining solutions for BTC, LTC, and DOGE without hardware requirements.

DNSBTC's infrastructure spans data centers across the U.S., Canada, and Iceland, featuring daily payouts and a $60 signup bonus. Their 1.6% daily return contracts represent a growing trend of passive crypto income strategies as institutional interest surges.

PELOSI Act Advances with Narrow Senate Committee Vote, Targeting Lawmaker Crypto Trading

The U.S. Senate committee narrowly approved the Preventing Elected Leaders from Owning Securities and Investments (PELOSI) Act in an 8-7 vote. The legislation aims to ban lawmakers and their families from trading individual stocks and digital assets, including cryptocurrencies, during their tenure.

Senator Josh Hawley (R-Mo.) crossed party lines to support the bill, while most Republicans argued it could deter qualified candidates from public service. Named after former House Speaker Nancy Pelosi—who faced unproven insider trading allegations—the act addresses longstanding concerns about lawmakers profiting from privileged information.

The contentious vote revealed deep divisions, with critics calling the expedited process a "publicity stunt." The outcome signals growing scrutiny of cryptocurrency holdings among government officials as digital assets gain prominence in financial markets.

PayPal to Roll Out 'Pay With Crypto' Feature for Merchants Amid Shift to Cloud Mining

As cryptocurrency markets navigate heightened volatility, retail investors are increasingly turning to cloud mining for stable passive income. QFSCOIN has emerged as a notable player, offering a $30 free mining bonus, daily payouts, and AI-powered tools for Bitcoin, Litecoin, and Dogecoin mining.

The Minnesota-registered platform operates regulated data centers across four countries, eliminating hardware requirements. Its free tier and fixed-return contracts—ranging from beginner to institutional levels—are drawing attention in a market where ease of access rivals yield potential.

Litecoin Approaches Key Resistance as Bullish Momentum Builds

Litecoin (LTC) has emerged from a consolidation phase with renewed upward momentum, now testing the psychologically significant $150 resistance level. The altcoin's recent price action suggests growing institutional interest, with network activity and bullish sentiment fueling its ascent.

Market structure now favors buyers, though LTC faces a critical juncture. After peaking near $120 earlier this month, the cryptocurrency underwent a expected correction while maintaining strong support at $105. Technical indicators point to potential continued upside, with the weekly Ichimoku cloud nearing a bullish crossover.

Long-term charts remain decidedly bullish despite short-term volatility. Analysts note the formation of a double-bottom pattern, with $200 emerging as a plausible next target should current accumulation patterns hold. The coming weeks will prove decisive for LTC's attempt to challenge its all-time highs.

SEC Delays Grayscale's Litecoin ETF Decision to 2025, LTC Holds Steady Near $109

The U.S. Securities and Exchange Commission has extended its review period for Grayscale's proposed spot Litecoin ETF, pushing the final decision deadline to October 10, 2025. The regulatory delay introduces near-term uncertainty but hasn't dampened Litecoin's market performance—LTC has gained 27% in July despite the setback.

Litecoin's price action remains technically strong, currently consolidating near $109.5 after recent gains. Analysts observe bullish chart patterns that could propel LTC toward $120 if key resistance levels break. The proposed ETF conversion would provide traditional investors with regulated exposure to Litecoin through conventional markets.

Market participants continue monitoring technical indicators across multiple timeframes while weighing the implications of prolonged regulatory scrutiny. Litecoin's resilience during this period underscores growing institutional interest in altcoins beyond Bitcoin and Ethereum.

How High Will LTC Price Go?

Based on technicals and market sentiment, BTCC's Michael suggests LTC could test the $120-125 range if it breaks current resistance. Key factors to watch:

| Indicator | Current Value | Implication |

|---|---|---|

| Price vs 20MA | 109.91 > 107.487 | Bullish |

| MACD Histogram | 0.5585 | Positive momentum |

| Bollinger Band Position | Near upper band | Potential overbought |

News developments around adoption and regulation will be crucial for sustained upside.